According to SAVI, one third of Marion County’s nearly 300,000 owner-occupied parcels has experience assessed value increases of more than three percent from 2015 to 2016. However, most of these properties were worth more than $100,000 and would not qualify for the tax relief. Fifteen percent of owner-occupied parcels are worth $100,000 or less and saw assessed value increase by more than three percent. For those households, the typical (median) household saw assessed value increase by five percent.

*Homeowners in this category, if they owned their home for more than 10 years and lived in a designated area, would qualify for the program.

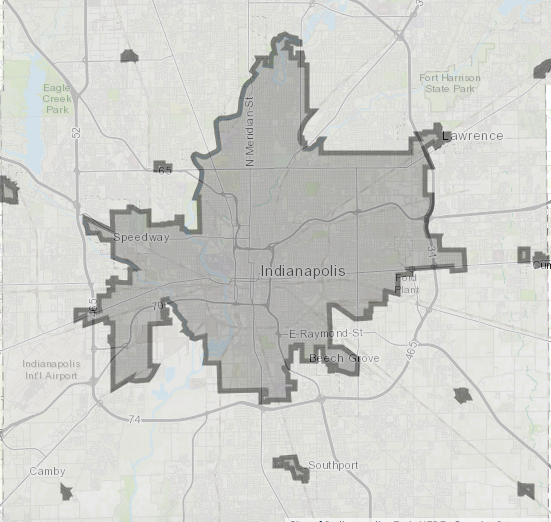

While these figures show the scope of climbing property values across the city, the critical piece of this legislation is the creation of designated areas within the city where the tax-relief would apply. These are required to be mainly residential areas and cannot make up more than five percent of the city.

The law describes the characteristics of these “designated areas” (high vacancy and abandonment, but expecting a rise in market value from rehab and infill), but it does not indicate how these areas should be measured. As a starting place, policy makers could look at areas where low and moderate value homes are increasing in assessed value quickly.

This map shows, for each block group in Marion County, the number of owner-occupied homes per square mile that meet these criteria: 1) are assessed at $100,000 or less and 2) experienced an increase in assessed value of more than 3% from 2015 to 2016.

Philadelphia’s Long-Time Owner-Occupants Program is a well-known example of a similar approach. In that case, however, owners are protected from assessed value increases of more than 300 percent, meaning the law does not kick in unless a home’s value tripled in one year. Philadelphia is experiencing dramatic changes in assessed value as it adjusts assessments to better match market value. Previously, assessments had been just a fraction of market value.

Lexington, Kentucky is considering a similar program. In its version of the policy, the tax relief kicks in if value goes up by more than twelve percent. Its program is also income qualified. Indiana’s law would not allow income as an eligibility factor.

While affordable rental housing can mitigate some of the impacts of gentrification for renters, policies like these property tax relief programs could be effective for long-time homeowners. In Indianapolis, the requirements of the proposed bill offer a useful framework to analyze changing property values.